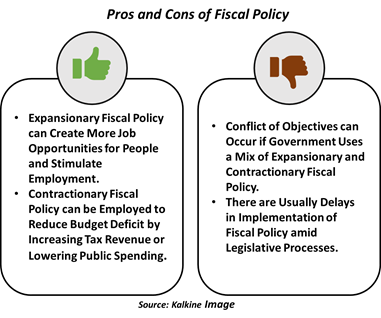

An expansionary fiscal policy involves increasing spending or cutting taxes to prevent or end a recession or depression. Second Quarter Ended.

Fiscal Policy Overview Of Budgetary Policy Of The Government

Such policies are framed concerning their impact on the country ie on consumers organizations investors foreign markets etc.

. The Treasury Department released the final rule for the Coronavirus State and Local Fiscal. Discretionary changes in government spending and taxes. The effects of fiscal and monetary policy on output Monetary policy and the transmission mechanism The liquidity trap The classical case The quantity theory of money Fiscal policy and crowding out Monetary accommodation The effects of alternative policies on the composition of output The US.

Terms relating to fiscal policy. What is Fiscal Policy. For instance when the UK government cut the VAT in 2009 this was intended to produce a boost in spending.

Changes in the money supply. In periods of nominal wage restraint even a small increase in inflation can lead to a fall in real wages. An Update for 2018Office of Management and.

FY 2021 Table S-5Page 113. In economics and political science fiscal policy is the use of government revenue collection taxes or tax cuts and expenditure to influence a countrys economy. The amount of tax we pay increases if there is inflation.

C full employmentD public debt. Economic stimulus refers to attempts by governments or government. This press release also refers to Adjusted EBITDA and Adjusted Net Income non-GAAP financial measures the terms for which definition and reconciliation are presented below.

Fiscal usually refers to government finance. On its own fiscal policy is the collection and expenditure of revenue by government. This is because with rising wages more people will slip into the top income tax brackets.

This refers to whether the government is increasing AD or decreasing AD eg. Fiscal policy is a much broader category than monetary policy. A Budget for Americas Future.

Fiscal policy refers to the budgetary policy of the government which involves the government controlling its level of spending and tax rates within the economy. Fiscal policy use of government expenditure to influence economic development. 3 The PPACA refers to PL.

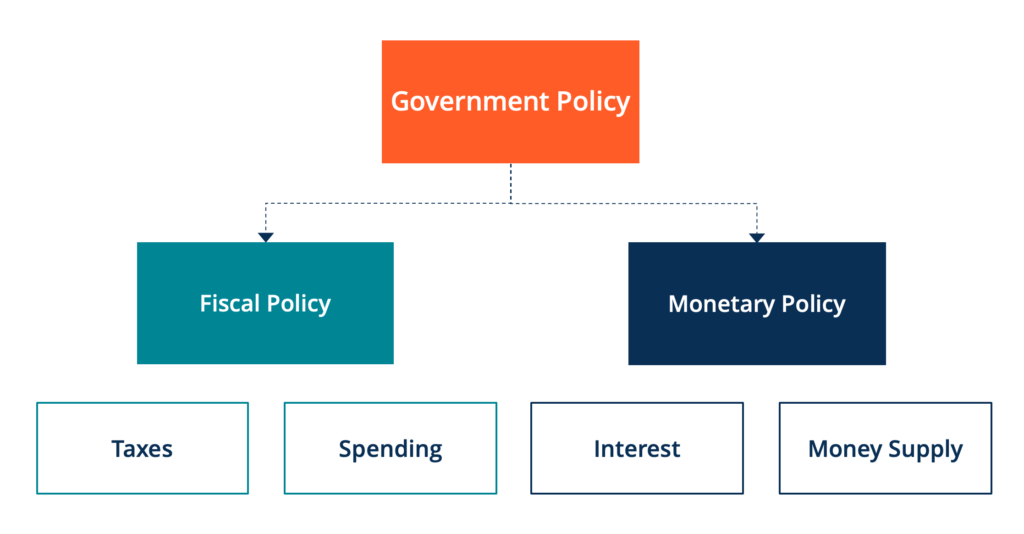

All taxing and spending decisions made by Congress fall into the category of fiscal policy. The government uses these two tools to influence the economy. Explore the tools within the fiscal policy toolkit such as expansionary and contractionary fiscal.

Now expansionary fiscal policy refers to a policy that seeks to grow the economy through fiscal stimulus. Expansionary or tight fiscal policy. Fiscal policy is the management of government spending and tax policies to influence the economy.

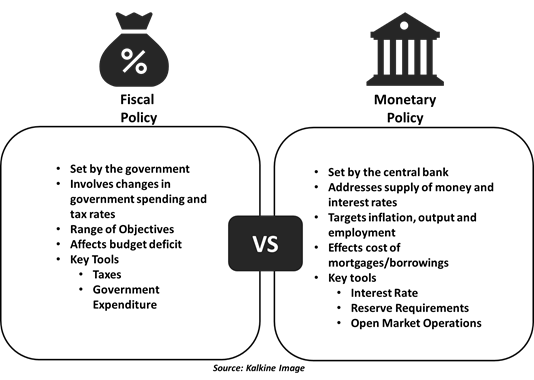

Congress sets fiscal policy with a lot of input from the executive branch. Fiscal agent a proxy that manages. Fiscal policy refers to government measures utilizing tax revenue and expenditure as a tool to attain economic objectives.

Fiscal policy refers to changes in tax rates and public spending. Monetary policy vs. In other words fiscal policy refers to how government collects money through taxes and what it spends money on ie.

GDP measures the size of the nations economy in terms of the total value of all final goods and services that are produced in a year. FY 2021 Table S-4Page 112. Public defence or welfare payments.

Discretionary fiscal policy refers to government policy that alters government spending or taxes. A sustainable fiscal policy is defined as one where the ratio of debt held by the public to GDP the debt-to-GDP ratio is stable or declining over the long term. It is the sister strategy to monetary policy.

The debate about the impact of fiscal policy on the economy has been raging for over a century but in general its believed that higher government spending helps stimulate the economy while lower spending acts a drag. Public debt or borrowing refers to the government borrowing from the public. Fiscal policy refers to the tools used by governments to change levels of taxation and spending to influence the economy.

US Treasury Final Rule. Monetary refers to the supply of money or the amount there is to spend. Fiscal implies the budget or how the money will be spent.

Reality and Outlook Page 1House Committee on the Budget. Fiscal policy refers to A. Federal Reserve Bank of St.

It is impossible for a government to default on its equity since the total returns available to all. Fiscal policy can be swayed by politics and placating voters which can. CHAPTER 11 MONETARY AND FISCAL POLICY Chapter Outline.

Fiscal policy refers to the actions of a governmentnot a central bankas related to taxation and spending. Automatic fiscal stabilisers If the economy is growing people will automatically pay more taxes VAT and Income tax and the Government will spend less on unemployment benefits. A Budget for Americas Future.

What is fiscal policy. The government is engaging in an. Fiscal adjustment a reduction in the government primary budget deficit.

Changes in the amount of physical capital in the economy. Changes in the interest rate. 33 terms The amount by which government expenditures exceed revenues during a particular 37 year is the A GDP gap.

Its purpose is to expand or shrink the economy as needed. The White House. This is a working documentPlease contact Emily Maher and Leo Garcia if you know of any additional information that should be reflected in the database or any errors that should be corrected.

In this context it may refer to. B Suppose the government purposely changes the economys cyclically adjusted budget from a deficit of 0 percent of real GDP to a deficit of 3 percent of real GDP.

Fiscal Policy Definition Meaning In Stock Market With Example

3 Types Of Fiscal Policy Boycewire

Fiscal Policy Definition Meaning In Stock Market With Example

What Is Fiscal Policy It Is An Essential Tool At The Disposable Of The Government To Influence A Nation S Econo Economics Lessons Teaching Economics Economics

0 Comments